Bookkeeping & Accounting Services

Judy Schwind

Lakewood, Washington

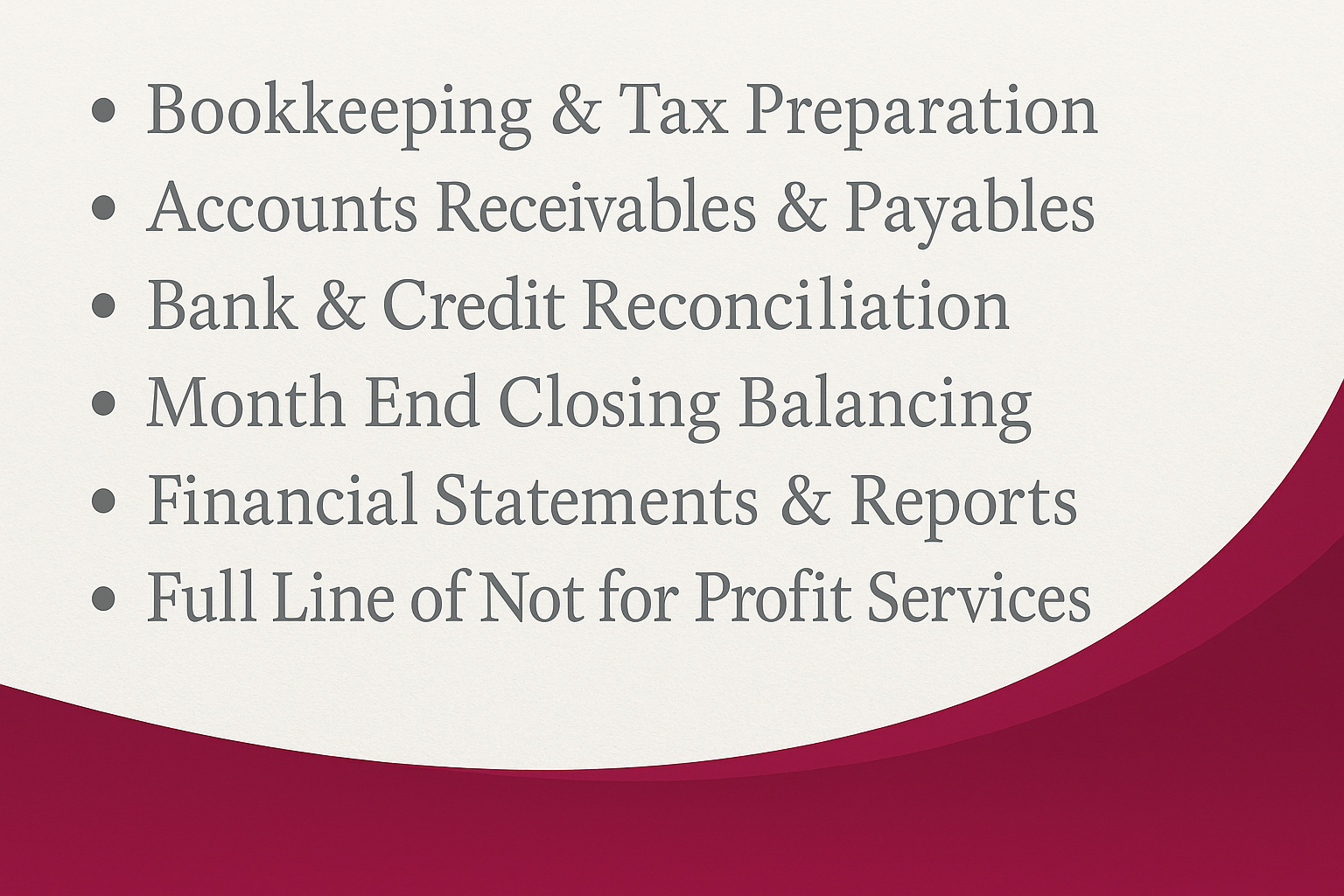

We cater to small businesses Bookkeeping & Accounting Services

Small business accounting involves tracking income, expenses, assets, and liabilities to ensure financial clarity and compliance. It includes essential services like bookkeeping, payroll, tax preparation, and financial reporting—helping business owners make informed decisions, maintain profitability, and stay in good standing with regulatory agencies.

Bookkeeping

Bookkeeping is the day-to-day process of recording and organizing financial transactions, such as sales, purchases, payments, and receipts. It provides the foundation for accurate financial reporting and ensures your business remains compliant, efficient, and ready for tax season. Reliable bookkeeping is key to understanding your company’s financial health.

Payroll Services

Payroll services ensure your employees are paid accurately and on time while handling tax withholdings, direct deposits, and compliance with state and federal regulations. By outsourcing payroll, businesses can reduce errors, save time, and stay focused on growth while meeting all employee compensation requirements.

Tax Preparation

Payroll services can be a standalone service independent of accounting or bookkeeping services. We also provide tax preparation for businesses and individuals. In addition, we also perform QuickBooks® consultation, installation and training.

We also provide grant writing to local non-profits.

Customized Accounting

Personalized Service

We truly care about and engage with the client to insure their success.

Flexible payments schedules, Customized accounting packages for their specific needs. Not a one size fits all concept. We are interested in building relationships in business, cultivating a relationship that instills trust and integrity that may lead into a lasting business client.